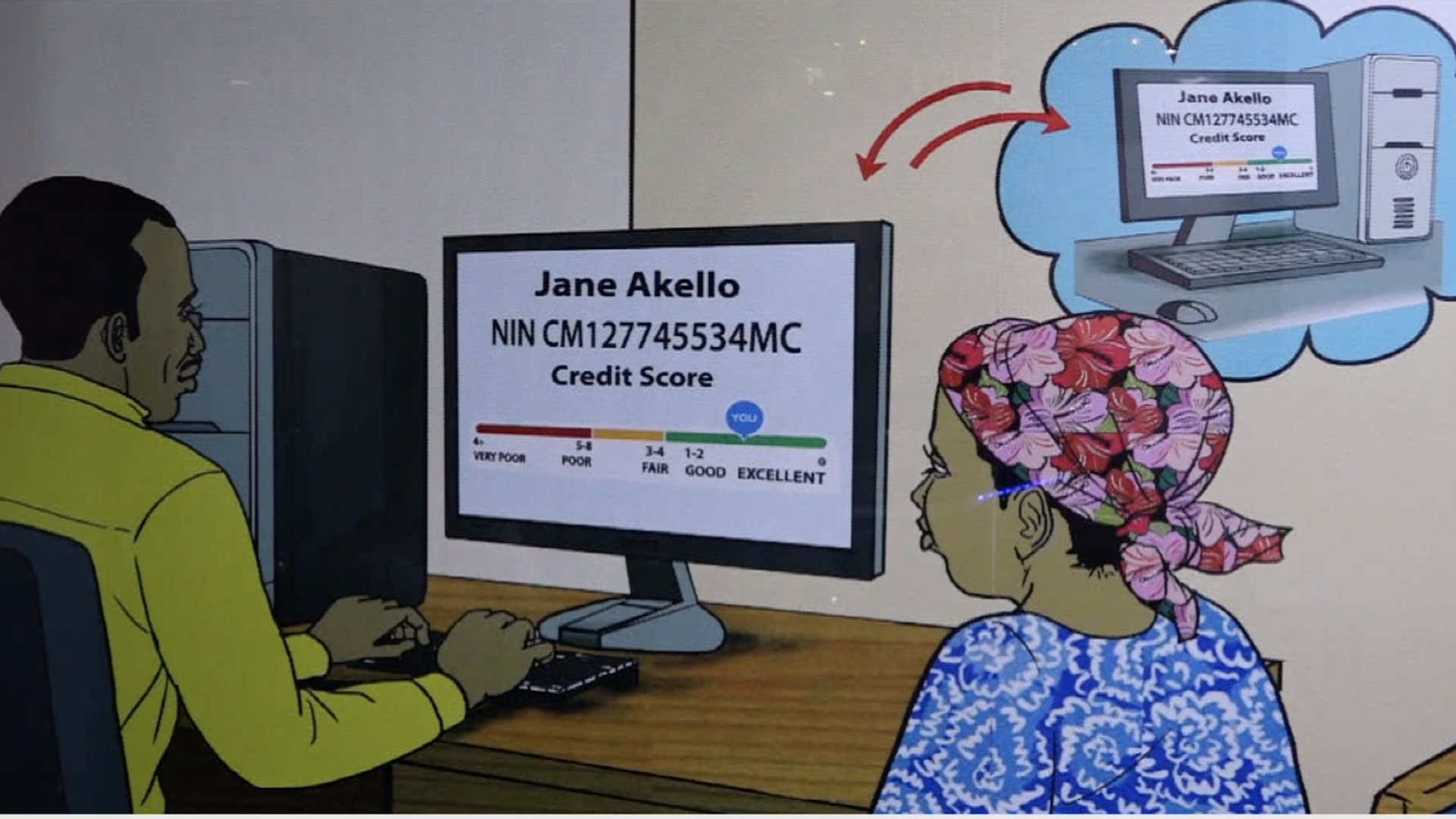

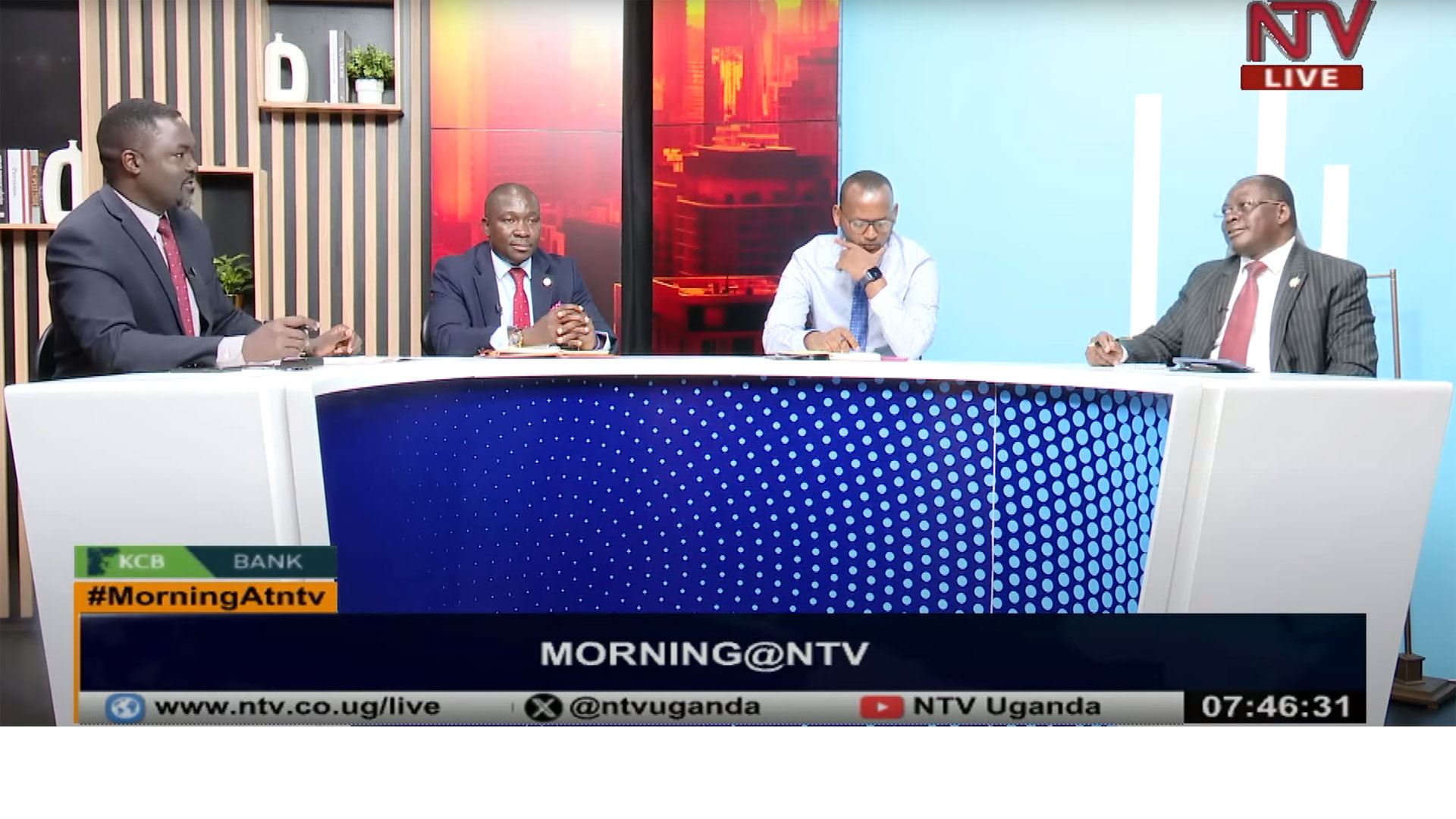

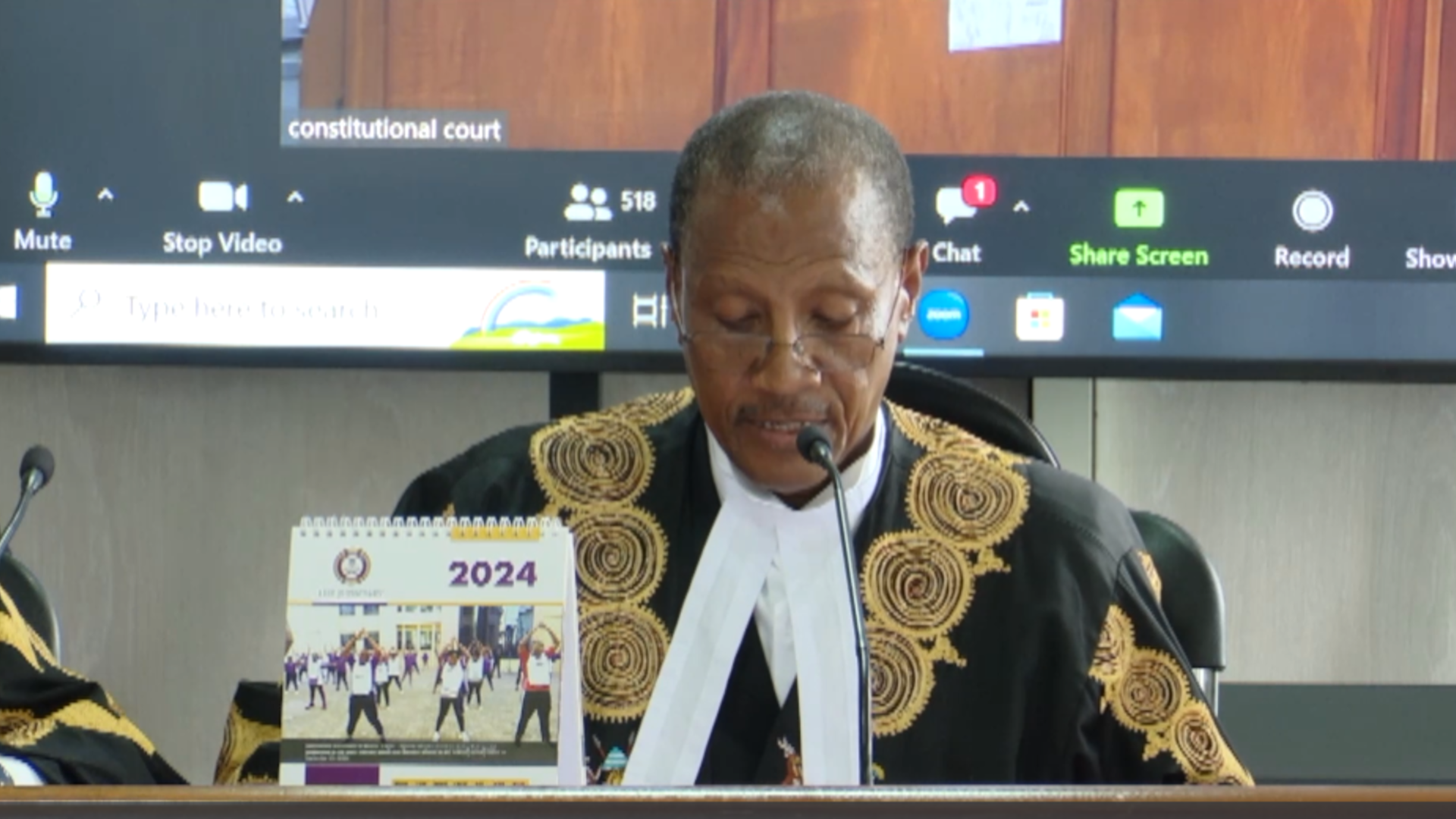

Micro-finance and deposit-taking institutions are leveraging non-traditional sources of data, such as mobile phone usage, utility payments, and commerce behavior, to assess the creditworthiness of individuals and small businesses who may lack a formal credit history, which is often the case in the micro-finance ecosystem. According to Giles Germany Aijukwe, the Chief Executive at Letshego, this is easing access for lenders in tier-four microfinance to the unbanked and reducing the risk of lending to individuals with limited financial footprints. He spoke to NTV Business on the sidelines of a loan product launch this morning, in partnership with Airtel Money and Gnugrid Credit Reference Bureau.

New loan product eases access for unbanked

- Category:

- Business News

- News

- Tags:

- AirtelMoney

- CreditWorthiness

- LoanProductLaunch

- MicrofinanceInnovation

- NewLoanProduct

- NTVBusiness

- UnbankedAccess